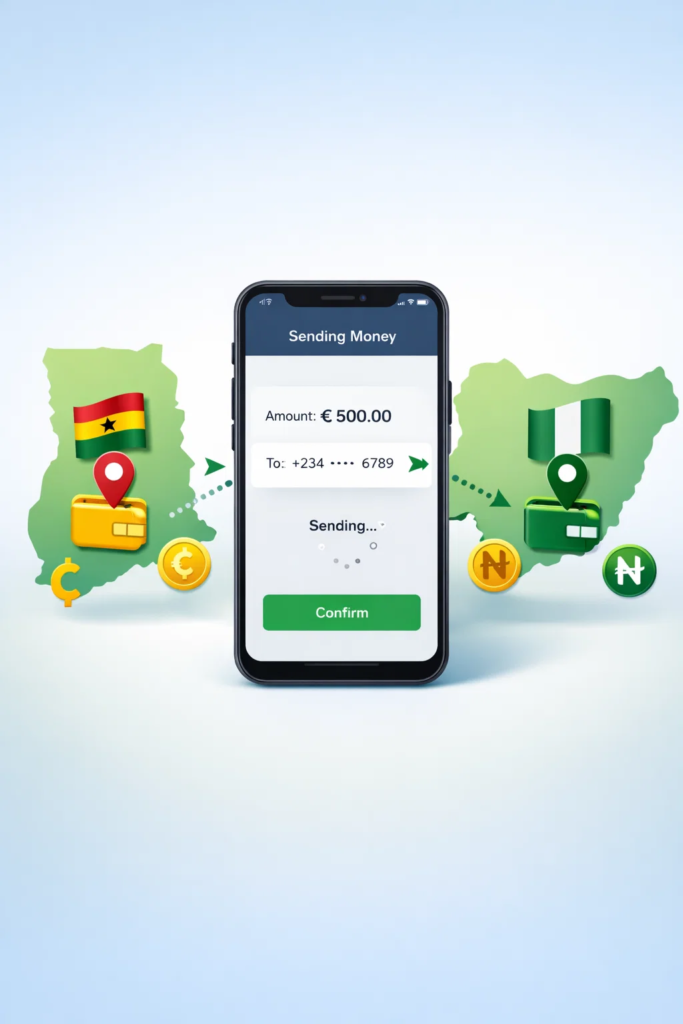

Sending money across African borders has become increasingly common, especially between Ghana and Nigeria. From students paying school-related expenses to families supporting loved ones and business owners handling cross-border transactions, the need for fast and reliable money transfers continues to grow. As economic ties between both countries strengthen, many people now search online for answers to questions like how to send money from Ghana to Nigeria or how can I send money from Ghana to Nigeria easily.

In the past, international money transfers were slow, expensive, and often required physical visits to banks or money transfer agents. Today, mobile money has transformed the process. With just a mobile phone, users can now send funds quickly, securely, and conveniently. This is why queries such as how to send money from Ghana to Nigeria using mobile money and how can I send money from Ghana to Nigeria using MTN mobile money are becoming more popular.

This guide explains how to send money from Ghana to Nigeria using mobile money, the available options, costs, requirements, and important things to know before making a transfer. Whether you’re sending money regularly or for the first time, this article will walk you through everything step by step.

Understanding Mobile Money Transfers Between Ghana and Nigeria

Mobile money is a digital financial service that allows users to store, send, and receive money using their mobile phones. In Ghana, mobile money is widely used, especially through networks like MTN Mobile Money (MoMo), Vodafone Cash, and AirtelTigo Money. Nigeria, on the other hand, relies more on bank accounts and fintech platforms, as mobile money is structured differently.

Because of this difference, sending money from Ghana to Nigeria usually involves mobile money on the Ghana side and bank accounts or digital wallets on the Nigerian side. This setup allows people to send money from Ghana to Nigeria without visiting a bank.

How to Send Money From Ghana to Nigeria Using Mobile Money

There are several reliable ways to send money from Ghana to Nigeria using mobile money. Below are the most common and trusted options.

1. Using MTN Mobile Money and International Transfer Partners

MTN Mobile Money is one of the most popular ways to send money from Ghana. While you cannot directly send MTN MoMo from Ghana to a Nigerian phone number, MTN partners with international remittance platforms that make the transfer possible.

Steps:

- Register and verify your MTN Mobile Money account in Ghana.

- Choose a supported international transfer service linked to MTN MoMo.

- Enter the Nigerian recipient’s bank details or wallet information.

- Confirm the amount and complete the transaction using your MTN MoMo PIN.

2. Sending Money Through Mobile Money–Enabled Fintech Platforms

Many fintech platforms now allow users to send money from Ghana to Nigeria using mobile money. These platforms accept MTN MoMo, Vodafone Cash, or AirtelTigo Money as payment methods in Ghana and deliver funds to Nigerian bank accounts.

How it works:

- The sender pays using mobile money in Ghana.

- The platform converts the funds.

- The recipient receives the money in naira directly into a Nigerian bank account.

This method is ideal for people asking how do I send money from Ghana to Nigeria without going to a bank.

3. Using Digital Wallets That Support Ghana–Nigeria Transfers

Some digital wallets operate in both Ghana and Nigeria. These wallets allow you to fund your account with mobile money in Ghana and transfer directly to Nigeria.

Benefits include:

- Faster transfer times

- Transparent exchange rates

- Lower fees compared to traditional remittance services

This option is growing in popularity among freelancers, remote workers, and online entrepreneurs.

How to Send Money to Nigeria From Ghana: Requirements

Before sending money, you’ll need the following:

- A registered mobile money account in Ghana.

- A valid ID (for verification, depending on the platform).

- The recipient’s Nigerian bank account details or wallet information.

- A stable internet connection (for app-based transfers).

Meeting these requirements makes the process smooth and secure.

How Long Does It Take to Send Money From Ghana to Nigeria?

Transfer time depends on the method used:

- Some mobile money transfers arrive within minutes

- Others may take a few hours or up to one business day

Delays may occur due to network issues, verification checks, or public holidays.

Cost of Sending Money From Ghana to Nigeria

The cost of sending money varies based on:

- The transfer platform

- Exchange rate margins

- Transaction fees

Most mobile money–based services are cheaper than traditional banks. Always check the total cost before confirming a transaction.

Can You Send Money From Nigeria to Ghana Using Mobile Money?

Yes, it is also possible to send money in the opposite direction. Many platforms support how to send money from Nigeria to Ghana, including options where Nigerian bank accounts or wallets can send funds to Ghanaian mobile money numbers.

Some services even support how to send money from Nigeria to Ghana through MTN mobile money, depending on the provider.

Safety Tips When Sending Money From Ghana to Nigeria

- Always double-check recipient details

- Use trusted platforms with strong security features

- Avoid sharing your mobile money PIN

- Confirm exchange rates before sending

Following these tips ensures your money reaches the right person safely.

Frequently Asked Questions (FAQs)

How can I send money from Ghana to Nigeria easily?

The easiest way is by using mobile money in Ghana through a trusted fintech platform that sends funds directly to Nigerian bank accounts.

How do I send money from Ghana to Nigeria using MTN Mobile Money?

You can use MTN MoMo through supported international transfer services that connect Ghanaian mobile money to Nigerian banks.

Can I send money from Ghana to Nigeria instantly?

Yes, many platforms offer near-instant transfers, although processing time may vary.

Is mobile money safe for international transfers?

Yes, when you use verified platforms and follow basic security precautions.

Conclusion: Making Cross-Border Transfers Easier With Queposts

Sending money from Ghana to Nigeria no longer has to be stressful or complicated. With mobile money, fintech platforms, and digital wallets, anyone can transfer funds quickly and securely without visiting a bank. Understanding your options helps you choose the method that best suits your needs, whether you’re supporting family, running a business, or handling personal expenses.

At Queposts, we simplify everyday financial decisions by providing clear, reliable, and Nigeria-focused guides. From money transfers and fintech solutions to smart consumer tips, Queposts helps you stay informed and confident in your choices. For more practical guides on mobile money, cross-border payments, and digital finance, Queposts remains your trusted source.